As we quickly approach the deadline for filing 1099-MISC or 1099-NEC, it is time to consider whether your business is ready to file.

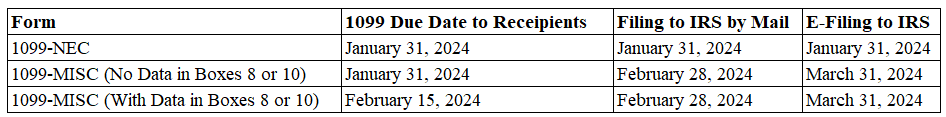

Note that Form 1099-NEC is utilized to report amounts of nonemployee compensation, while Form 1099-MISC is utilized to report other forms of compensation. The due date for furnishing 1099-MISC and 1099-NEC statements to recipients and to the IRS for the 2023 tax year is as follows:

Form 1099-MISC/1099-NEC are essentially utilized to report payments made to non-employee individuals or unincorporated businesses during the calendar year. As the filing of Form 1099-MISC/NEC remains a hot topic with the IRS, it is more important than ever to consider whether you are required to file Form 1099-MISC/NEC in the course of your trade or business.

Do you need to file 1099-MISC or 1099-NEC?

In general, you must file Form 1099 for each person to whom you have paid at least $600 in rents, services, prizes and awards, or other income payments made in the course of your trade or business during a calendar year. Examples of services performed by independent contractors or others (non-employees of your business) include:

Do you need to file 1099-MISC or 1099-NEC?

In general, you must file Form 1099 for each person to whom you have paid at least $600 in rents, services, prizes and awards, or other income payments made in the course of your trade or business during a calendar year. Examples of services performed by independent contractors or others (non-employees of your business) include:

- Professional Services

- Accountants

- Construction

- Landscapers

- Custodial Services

- Electricians

- Consultants

- Attorneys

- IT (Information Technology)

It is always a good idea upon hiring a contractor to obtain a W-9 Form. This form can easily be found on the IRS website. The W-9 form will give you contact information, vendor’s tax identification number and type of tax entity. As a customer, it protects you from paying illegal vendors and includes all the required information you will need in order to prepare Form 1099-MISC/NEC.

One other notable exceptions to filing 1099 forms is if a payment was made with a third-party payment application (such as Venmo and PayPal) or credit card. Credit card companies and third party payment companies are required to provide Form 1099-K, so payments made through credit card or third party payment application should not be reported on 1099-NEC or 1099-MISC as they would be double-counted.

What if I choose not to file or do not have all the proper information?

Failure to file correct information returns by the due date can be costly. If you fail to file a correct information return by the due date, and you cannot show reasonable cause, you may be subject to penalties. Penalties apply if you fail to file timely, you fail to include all information required to be shown on a return, or you include incorrect information on a return. Penalties also apply if you file on paper when you were required to file electronically, you report an incorrect TIN or fail to report a TIN, or you fail to file paper forms that are machine-readable.

The amount of the penalty for 2023 tax year is based on when you file the correct information return and is outlined below in further detail:

- $60 per information return if you correctly file within 30 days; maximum penalty $630,500 per year ($220,500 for small businesses as defined by the IRS).

- $120 per information return if you correctly file more than 30 days after the due date but by August 1; maximum penalty $1,891,500 per year ($630,500 for small businesses as defined by the IRS).

- $310 per information return if you file after August 1 or you do not file required information returns; maximum penalty $3,783,500 per year ($1,261,000 for small businesses as defined by the IRS).

How can you tell if you need to file a Form 1099-MISC or 1099-NEC?

You are not required to file Form 1099 if any of the following apply:

- You are not engaged in a trade or business.

- You are engaged in a trade or business and payments are made to a corporation, but were not for legal services.

- The sum of all payments made to the person or unincorporated business are less than $600 in one calendar year.

What do I do if I get a 1099?

DO NOT IGNORE IT! The IRS expects that gross business income or miscellaneous income reported on a tax return equal or exceed the total of any 1099s reported to a taxpayer. If you think you received one in error or the form you received is incorrect, you should contact the payor to request a corrected form.

For more information from the IRS about filing Form 1099-MISC and 1099-NEC take a look at their instructions.

For returns due in 2024, the IRS has significantly reduced the filing limitations allowed to paper file. Keep an eye out for our upcoming blog post, How Many Returns Can A Filer File Without Having to Efile?

As always, our CPAs at Mason + Rich are ready to answer any additional questions. Feel free to contact us and follow us on LinkedIn to stay up-to-date on all of our posts.

RSS Feed

RSS Feed