Dustin Ladd, CPA •

If you placed in service a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after, you may qualify for a new clean vehicle tax credit up to $7,500.

If you placed in service a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after, you may qualify for a new clean vehicle tax credit up to $7,500.

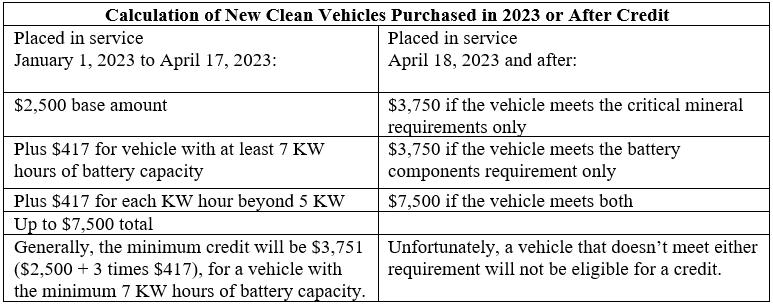

The credit is calculated depending on when you placed the vehicle in service (took delivery), regardless of the purchase date.

If you placed the vehicle in service after April 18, 2023, regardless of the purchase date, it must meet critical mineral and battery component requirements to qualify for the credit.

If you placed the vehicle in service after April 18, 2023, regardless of the purchase date, it must meet critical mineral and battery component requirements to qualify for the credit.

If you purchased a qualified used EV or FCV for $25,000 or less from a licensed dealer in 2023, you may be eligible for a used clean vehicle tax credit. The nonrefundable credit equals 30% of the sales price up to a maximum credit of $4,000.

These credits are subject to certain requirements and AGI limitations. Please reach out if you would like to discuss these with your CPA.

Please visit the IRS website for additional information:

New Clean Vehicle Tax Credit

Used Clean Vehicle Tax Credit

RSS Feed

RSS Feed