Alyssa McBride, CPA •

In the growing world of ecommerce, it is becoming easier and easier to sell things and make some money. You may be sure that your venture is a business and have your accountant put your income and expenses on Schedule C of your tax return. However, you take a lot of enjoyment out of the activity and know in the back of your mind that you would continue even if the activity were not profitable. So when does it become a hobby rather than a business?

In the growing world of ecommerce, it is becoming easier and easier to sell things and make some money. You may be sure that your venture is a business and have your accountant put your income and expenses on Schedule C of your tax return. However, you take a lot of enjoyment out of the activity and know in the back of your mind that you would continue even if the activity were not profitable. So when does it become a hobby rather than a business?

Typically, the IRS determines that three years of losses during the past five years shows that your business is actually a hobby. This can be unfortunate for your tax situation because if you have a hobby, you have to report your income but related expenses can only be deducted as an itemized deduction on your tax return (subject to the 2% of adjusted gross income limitation) and only up to the amount of income. If you do not itemize, you will not get to deduct any of the losses against the income. One positive note is that hobby income is not subject to the self-employment tax of 15.3%, but rarely does this benefit the hobby treatment.

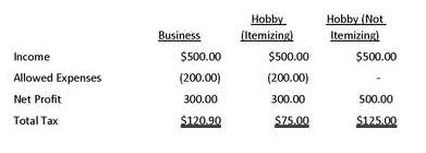

Consider a new venture that made $500 selling widgets this year. You have $200 of expenses for materials and a net profit of $300. Assuming a 25% tax rate, the following would be your related tax:

Consider a new venture that made $500 selling widgets this year. You have $200 of expenses for materials and a net profit of $300. Assuming a 25% tax rate, the following would be your related tax:

While the hobby is beneficial in this situation if you can itemize, it is never beneficial if the expenses exceed the income. As nearly 70% of Americans use the standard deduction, you are unlikely to see any benefit from having a hobby.

How can you prevent your venture from being treated as a hobby? You generally have to appear as though you are conducting a business. Having a separate bank account, keeping track of your income and expenses, and having a written business plan all help. It also helps if you depend on the activity for your livelihood, if you are attempting to improve profitability, if you have advisors to make your business successful, if you have been successful in the past in similar ventures, or if you can expect to make a profit in the future, possibly from the sale of assets. Generally, if you set up a business entity you will have more likelihood that the IRS will believe it is a business, however, only corporations are safe from the IRS considering the “hobby loss” rules.

The harder you try to make your venture profitable, the more likely it will come across as a business.

How can you prevent your venture from being treated as a hobby? You generally have to appear as though you are conducting a business. Having a separate bank account, keeping track of your income and expenses, and having a written business plan all help. It also helps if you depend on the activity for your livelihood, if you are attempting to improve profitability, if you have advisors to make your business successful, if you have been successful in the past in similar ventures, or if you can expect to make a profit in the future, possibly from the sale of assets. Generally, if you set up a business entity you will have more likelihood that the IRS will believe it is a business, however, only corporations are safe from the IRS considering the “hobby loss” rules.

The harder you try to make your venture profitable, the more likely it will come across as a business.

RSS Feed

RSS Feed