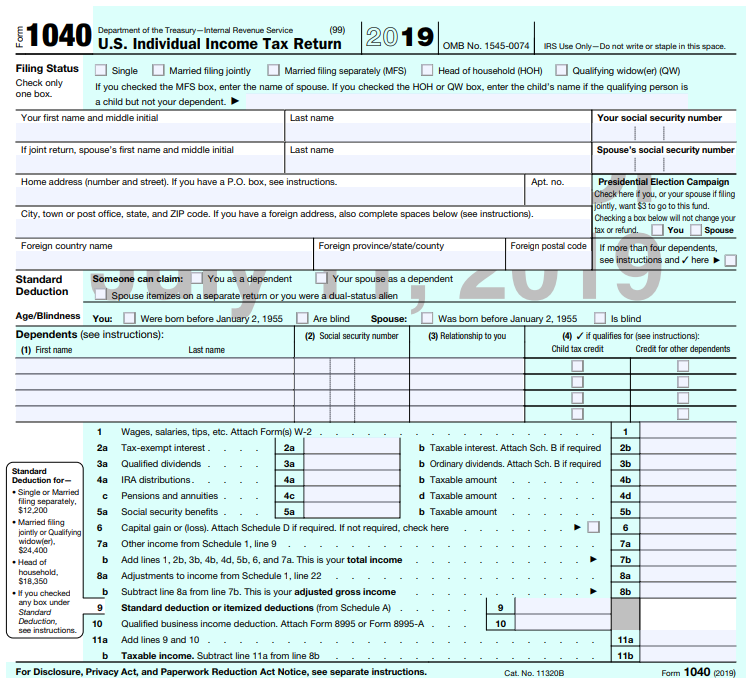

The IRS recently released draft forms for the 2020 tax season. The 1040 will look more familiar with page 1 again including income. In addition, the six schedules from 2018 are now reduced to three. The changes from 2018 to 2019 are detailed as follows:

- Schedule 1: Additional Income and Adjustments to Income remains similar to 2018

- Schedule 2: Tax becomes 2019 Schedule 2: Tax (Part I)

- Schedule 3: Nonrefundable Credits becomes 2019 Schedule 3: Additional Credits and Payments (Part I)

- Schedule 4: Other Taxes becomes 2019 Schedule 2: Tax (Part II)

- Schedule 5: Other Payments and Refundable Credits becomes 2019 Schedule 3: Additional Credits and Payments (Part II)

- Schedule 6: Foreign Address and Third Party Designee is now included as part of page 1 and page 2 of 2019 Form 1040

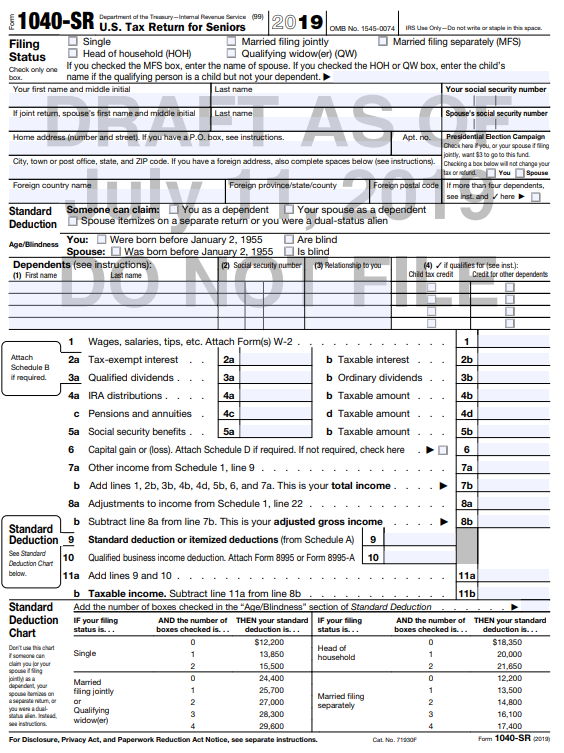

Also new for next years’ taxes is a new 1040, Form 1040-SR, which looks similar to the updated 1040, but with a larger font size and easier to view color scheme. This form is believed to be used for senior citizens aged 65 and older who simply want a form that is easier to read. Some sources say that to use this form you must use the standard deduction rather than itemizing, but the current language will need to be modified if that is true.

The IRS cautions that draft forms could change and final forms will be posted later in the summer. To see the new forms and schedules, check out the IRS’ Draft Tax Forms website.

RSS Feed

RSS Feed