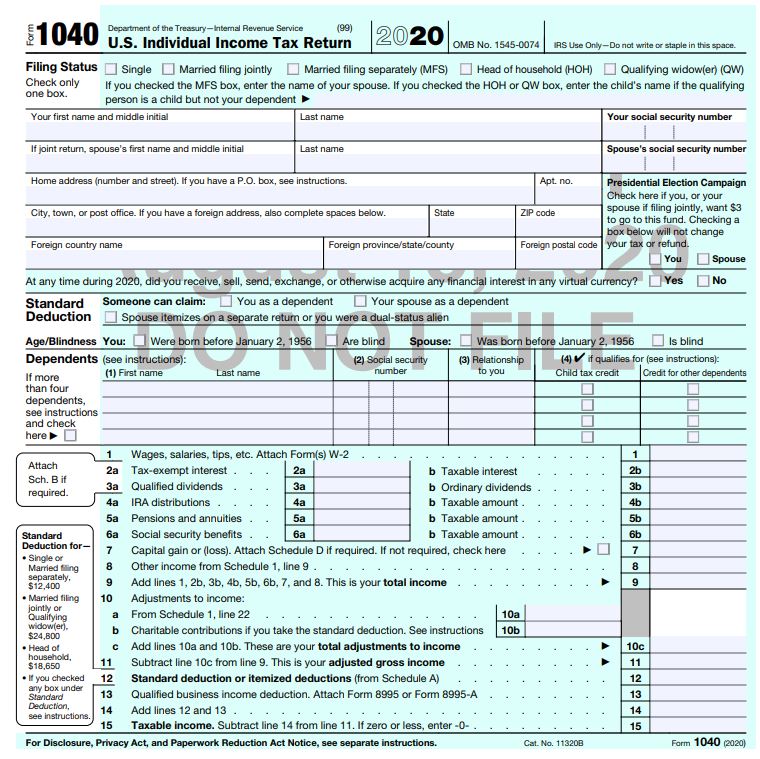

The IRS recently released draft forms for 2020 taxes, to be filed in 2021. The 1040 will look similar to the 2019 Form 1040, with a few modifications. The most significant changes on page 1 are:

- The virtual currency question has been moved from Schedule 1 to the first page of the 1040

- Adjustments on page 1 now includes a charitable contribution deduction for taxpayers who take the standard deduction. As part of the CARES act, taxpayers can now deduct up to $300 of charitable contributions even if they take the standard deduction. Schedule 1 is still available for other adjustments.

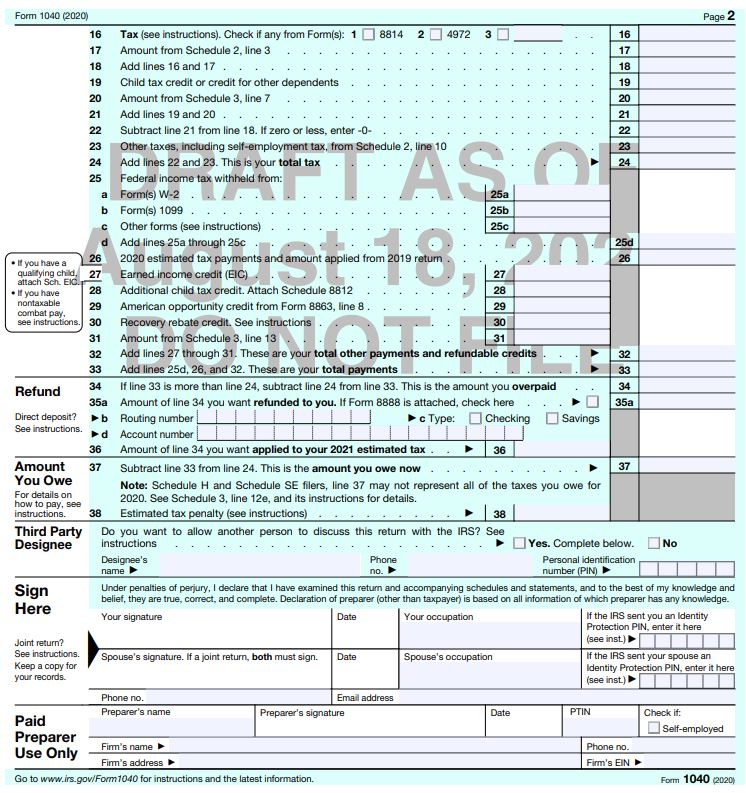

Page 2 has some additional notable changes:

- The line for withholdings now has three sublines to break out amounts withheld on Form(s) W-2, Form(s) 1099, and Other forms.

- Estimates and applied overpayments are also called out for 2020. Line 26 now reads: “Estimated taxes and amounts applied from the prior year tax return.” Previously these amounts would have been reported under “Other payments and refundable credits.”

- Another new loan on Page 2 is line 30, Recovery rebate credit. This credit will relate to the economic impact payments that were received by taxpayers during 2020 which were considered to be an advance of a credit on the 2020 tax return. The line refers to instructions but those are not yet drafted.

The IRS also released many other updated forms which can be found on their Draft Tax Forms website. These include Schedule 1, 2, and 3, which will be similar to 2019 reporting. Schedule 1 (adjustments to income) no longer includes the virtual currently question but otherwise appears unchanged from the 2019 form. Schedule 2 (additional taxes) appears unchanged and Schedule 3 (additional credits) includes some additional breakout for Other payments or refundable credits.

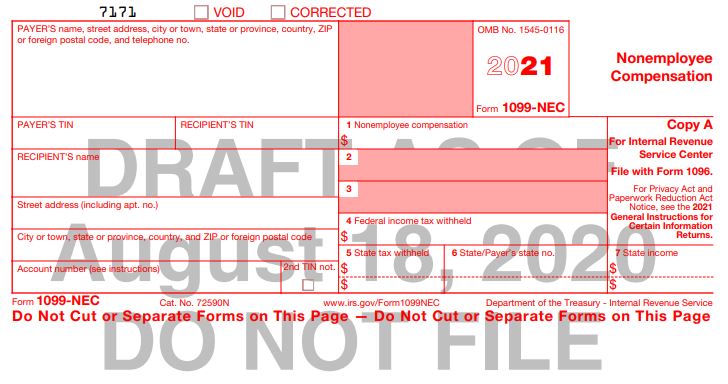

One of the new draft forms is 1099-NEC for 2021 (below). 1099-NEC will be first used for 2020 and the 2020 form was approved in November 2019. Nonemployee Compensation will be reported separately from form 1099-MISC. This form is more straightforward from 1099-MISC as it only reports one type of compensation and will be received by many individuals who are independent contractors. Other income commonly reported on 1099-MISC remains the same, however, keep in mind the boxes may have shifted due to this change.

One of the new draft forms is 1099-NEC for 2021 (below). 1099-NEC will be first used for 2020 and the 2020 form was approved in November 2019. Nonemployee Compensation will be reported separately from form 1099-MISC. This form is more straightforward from 1099-MISC as it only reports one type of compensation and will be received by many individuals who are independent contractors. Other income commonly reported on 1099-MISC remains the same, however, keep in mind the boxes may have shifted due to this change.

Keep in mind that draft forms are still subject to potential change. The IRS will post updated forms when they are finalized.

If you have any questions, reach out to your accountant!

If you have any questions, reach out to your accountant!

RSS Feed

RSS Feed