Alyssa McBride, CPA •

As an individual, you may feel like your retirement plan options are limited. If your employer offers a 401(k) hopefully you participate, but are you taking advantage of all your options?

If your employer offers a 401(k) plan you can contribute up to $18,000 in 2017 plus an additional $6,000 if you are age 50 or older. If your employer instead offers a SIMPLE (Savings Incentive Match Plan for Employees) plan you can contribute $12,500 plus an additional $3,000 if you are age 50 or older.

As an individual, you may feel like your retirement plan options are limited. If your employer offers a 401(k) hopefully you participate, but are you taking advantage of all your options?

If your employer offers a 401(k) plan you can contribute up to $18,000 in 2017 plus an additional $6,000 if you are age 50 or older. If your employer instead offers a SIMPLE (Savings Incentive Match Plan for Employees) plan you can contribute $12,500 plus an additional $3,000 if you are age 50 or older.

In addition to workplace contributions, an individual can also contribute $5,500 to an IRA plus a $1,000 catch-up contribution if you are age fifty or older.

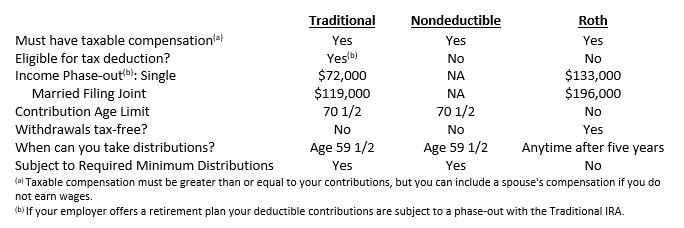

There are three types of IRAs: (1) Traditional (2) Roth and (3) Nondeductible. Below is a chart summarizing the IRA differences:

There are three types of IRAs: (1) Traditional (2) Roth and (3) Nondeductible. Below is a chart summarizing the IRA differences:

As illustrated above you might be phased out of making Traditional or Roth retirement contributions, alternatively, you may contribute to a non-deductible IRA. The non-deductible IRA contribution is a great way to save for retirement, however, it’s important to consult with your tax professional before making these contributions because of the impact on your tax liability at the point of contribution and distribution.

Now that you know some of the basics of retirement plans you can start making decisions on how to make your retirement contributions! You may still be asking yourself should I contribute to a 401K plan, SIMPLE, or an individual IRA? Should my 401K or IRA contribution be a Traditional or Roth retirement contribution? We know making these decisions can be overwhelming because we are asked these questions all the time. To help you simplify this difficult decision we’ve included some helpful tips below:

Now that you know some of the basics of retirement plans you can start making decisions on how to make your retirement contributions! You may still be asking yourself should I contribute to a 401K plan, SIMPLE, or an individual IRA? Should my 401K or IRA contribution be a Traditional or Roth retirement contribution? We know making these decisions can be overwhelming because we are asked these questions all the time. To help you simplify this difficult decision we’ve included some helpful tips below:

- As noted above, the retirement vehicles offered by your employer would be either a SIMPLE IRA or a 401(k) plan. If your employer offers either of these plans, consider making the maximum SIMPLE IRA or 401(k) plan contributions because you will be maximizing your retirement plan contributions under these plans.

- If you are an employee and your employer does not offer a retirement plan than your options are limited to the individual retirement account (IRA) whether it be a traditional IRA or Roth IRA. We recommend that you work proactively with your CPA and investment advisor to setup an IRA.

- If you are the employer, you have the ability to setup a 401(K) plan, SIMPLE IRA, or an individual IRA for you and your employees. There are even more retirement plan savings vehicles for those employers but these are your most common retirement plans and a great place to start.

- Tax deferral contributions (pre-tax contributions) or Roth contributions (post-tax) may be available under 401(k) Plans, SIMPLE IRAs, and IRAs. Your human resource department or employer will have information about pre-tax or post-tax contribution options for 401(k) plans and SIMPLE IRAs. For those with IRAs please consult with your CPA or investment advisors for your options.

- Roth Contributions are recommended if you expect to be in a higher tax bracket when you take distributions since the earnings on Roth Contributions come out tax-free. Conversely, if you expect to be in a lower tax bracket in your later years, have no need to take distributions before 59 ½, and do not mind the required minimum distributions, you may want to make traditional contributions.

- If you want to avoid the requirement of taking required minimum distributions, you should consider making Roth Contributions.

- If you may need distributions before you are age 59 ½, you should consider making ROTH contributions but consult with your CPA regarding the tax implications with early ROTH withdrawals.

- If you need the ability to make hardship withdrawals, consider making IRA contributions, which are typically more flexible than 401(k) plans.

- One common tax strategy is that if you are over the income limits for contributing to a Roth IRA, you can contribute to a nondeductible IRA and immediately roll it over to a Roth. This is typically referred to as a “back-door Roth”.

- Keep in mind that that you can make contributions to both 401(k)s and IRAs up to the due date of your tax return. I.e., if eligible you could contribute $5,500 to a Roth IRA on April 15.

- You also may be eligible for the Retirement Savings Contributions Credit. If you are a single taxpayer, you can get an additional credit if your adjusted gross income (AGI) is less than $31,000 and if you file married-filing-joint, you can get a credit if your AGI is less than $62,000.

RSS Feed

RSS Feed