Over the past few years, cryptocurrency has been a complex tax issue that the IRS has been trying to deal with. Recently, the IRS has provided more clarity on what is considered cryptocurrency and what needs to be reported on an individual’s 1040 individual income tax form.

How will it appear on my 1040 tax return?

The IRS has changed the verbiage from “virtual currency” to “digital assets.” This is in response to the 2021 infrastructure bill amending Section 6045 of the Internal Revenue Code to expand the cryptocurrency reporting requirements. The change is to address ambiguity about what is considered cryptocurrency. Non-fungible token, virtual currencies as well as mining, staking, and decentralized finance activities, such as liquidity pools, are considered digital assets and are included in taxable income.

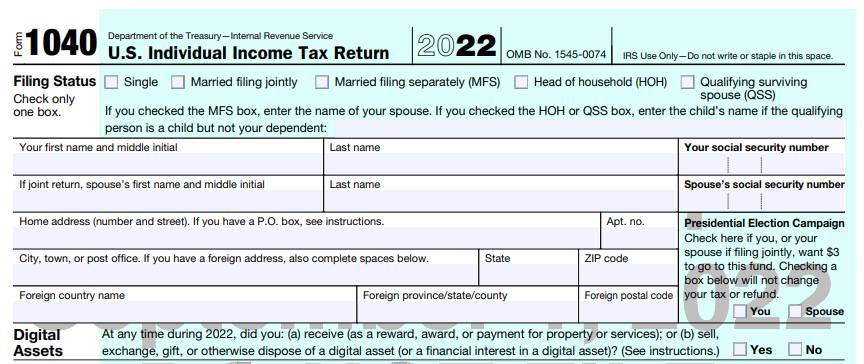

See below for the section on “digital assets” which was updated on the individual income tax return form for 2022. If you receive, sell, exchange, gift, or dispose of a digital asset anytime during the year, you are required to check “yes” to this question on your 1040 tax return.

The IRS has changed the verbiage from “virtual currency” to “digital assets.” This is in response to the 2021 infrastructure bill amending Section 6045 of the Internal Revenue Code to expand the cryptocurrency reporting requirements. The change is to address ambiguity about what is considered cryptocurrency. Non-fungible token, virtual currencies as well as mining, staking, and decentralized finance activities, such as liquidity pools, are considered digital assets and are included in taxable income.

See below for the section on “digital assets” which was updated on the individual income tax return form for 2022. If you receive, sell, exchange, gift, or dispose of a digital asset anytime during the year, you are required to check “yes” to this question on your 1040 tax return.

What virtual currency transactions are taxable?

There are certain transactions that are required to be reported as taxable income. You must report the transaction if you sell virtual currency for U.S. dollars, exchange one type of virtual currency for another, receive virtual currency for services, or mine virtual currency. Transactions that do not need to be reported include 1) when you buy virtual currency with dollars and hold on to it and 2) when you send virtual currency to a different virtual wallet or account with the same owner.

If you are an investor who trades and exchange cryptocurrency on the market, then the gains and losses of the transactions are taxed according to capital gain rates and are subject to a maximum $3,000 capital loss per year. However, if you are actively involved in acquiring cryptocurrency, including miners, traders, dealers, and those that receive it as compensation (or hard forks), are taxed at ordinary income rates, and can only deduct ordinary losses if associated with a §162 trade or business.

What happens when virtual currency is not reported correctly?

There are four types of letters a taxpayer can receive from the IRS if the IRS believes the taxpayer is not reporting virtual currency or not reporting it properly. In order from the least amount of risk to highest risk, these include: IRS letter 6174, IRS letter 6174-A, CP2000, and IRS letter 6173.

IRS letter 6174 and IRS 6174-A is an informational letter making the taxpayer aware they have virtual currency that may not have been properly recorded in the tax return. The only difference between the two letters is that 6174-A contains an additional warning note that the IRS may issue future correspondence about enforcement activity. Neither of these letters require a response sent to the IRS. IRS letter CP2000 is sent to taxpayers that the IRS believes owes taxes on their virtual currency, due to the information the IRS has on file. Taxpayers must respond to the IRS agreeing with their assessment or with documentation to contradict the IRS findings. The last and highest risk letter, IRS letter 6173, is sent to those who fail to report one or more virtual currency transactions. Individuals must respond with an amended or delinquent return by the date included in the original letter.

Virtual currency is an ongoing focus area for IRS Criminal Investigation. Therefore, taxpayers who do not properly report the income tax consequences of virtual currency transactions are, when appropriate, liable for tax, penalties, and interest. In some cases, taxpayers could be subject to criminal prosecution.

How do donations of cryptocurrency work?

If an individual donates cryptocurrency to a charitable organization, then the individual will not recognize income, gain, or loss from the donation. If the individual held onto the donation for more than a year, then the charitable deduction is equal to the fair market value of the cryptocurrency at the time of the donation. If the individual held onto the cryptocurrency for less than a year, on the other hand, then the charitable deduction is equal to the lesser of the basis in the cryptocurrency or the fair market value of the cryptocurrency at the time of the donation.

Cryptocurrency and digital/virtual assets are treated as property for income tax purposes. Therefore, donations of cryptocurrency are treated as “non-cash” and need to be reported on Form 8283, Noncash Charitable Contributions. If the individual donor claims a charitable deduction of more than $5,000, the charity is required to sign the donor’s Form 8283. The signature of the donee on Form 8283 does not substantiate the appraised value of the contributed property; it only acknowledges receipt of the property. Accepting donations of cryptocurrency can be risky and organizations must proceed with caution and have policies in place to ensure proper reporting.

If an individual donates cryptocurrency to a charitable organization, then the individual will not recognize income, gain, or loss from the donation. If the individual held onto the donation for more than a year, then the charitable deduction is equal to the fair market value of the cryptocurrency at the time of the donation. If the individual held onto the cryptocurrency for less than a year, on the other hand, then the charitable deduction is equal to the lesser of the basis in the cryptocurrency or the fair market value of the cryptocurrency at the time of the donation.

Cryptocurrency and digital/virtual assets are treated as property for income tax purposes. Therefore, donations of cryptocurrency are treated as “non-cash” and need to be reported on Form 8283, Noncash Charitable Contributions. If the individual donor claims a charitable deduction of more than $5,000, the charity is required to sign the donor’s Form 8283. The signature of the donee on Form 8283 does not substantiate the appraised value of the contributed property; it only acknowledges receipt of the property. Accepting donations of cryptocurrency can be risky and organizations must proceed with caution and have policies in place to ensure proper reporting.

Should small businesses invest their employee’s 401k plans in cryptocurrency?

The Department of Labor (DOL) recognizes the uptick in employers offering investments in cryptocurrency as part of their 401k plans. The DOL is cracking down on the risks of cryptocurrency as investment options as fiduciaries must abide to plan requirements and properly manage the plan assets. With investment in cryptocurrency comes the risk of fraud, theft, and loss because cryptocurrency is a speculative and volatile investment. Therefore, it could be challenging for fiduciaries and/or 401k plan participants to make informed decisions about cryptocurrency, especially with an evolving regulatory market and valuation concerns.

Cryptocurrency regulation is an ongoing and complex process since this is a new and evolving market. Individuals and employers must be aware of the risks in reporting virtual currency and be able to recognize what virtual currency transactions are taxable. Before donating cryptocurrency and/or investing 401k plan participants into cryptocurrency, careful consideration of the risks involved must be evaluated. As always, our CPAs at Mason + Rich are ready to answer any additional questions. Feel free to call us at 603-224-2000.

The Department of Labor (DOL) recognizes the uptick in employers offering investments in cryptocurrency as part of their 401k plans. The DOL is cracking down on the risks of cryptocurrency as investment options as fiduciaries must abide to plan requirements and properly manage the plan assets. With investment in cryptocurrency comes the risk of fraud, theft, and loss because cryptocurrency is a speculative and volatile investment. Therefore, it could be challenging for fiduciaries and/or 401k plan participants to make informed decisions about cryptocurrency, especially with an evolving regulatory market and valuation concerns.

Cryptocurrency regulation is an ongoing and complex process since this is a new and evolving market. Individuals and employers must be aware of the risks in reporting virtual currency and be able to recognize what virtual currency transactions are taxable. Before donating cryptocurrency and/or investing 401k plan participants into cryptocurrency, careful consideration of the risks involved must be evaluated. As always, our CPAs at Mason + Rich are ready to answer any additional questions. Feel free to call us at 603-224-2000.

RSS Feed

RSS Feed