Alyssa Hodges, CPA •

The IRS requires “contemporaneous” documentation for certain types of activities and tax deductions. Some of the areas this covers include mileage, meals, and support for the new 250 hour requirement for the rental real estate safe harbor. “Contemporaneous” means that you should be recording the necessary information at the same time you are doing the activity.

The IRS requires “contemporaneous” documentation for certain types of activities and tax deductions. Some of the areas this covers include mileage, meals, and support for the new 250 hour requirement for the rental real estate safe harbor. “Contemporaneous” means that you should be recording the necessary information at the same time you are doing the activity.

If you are not already familiar, the IRS has a safe harbor for rental real estate activities and being able to claim the §199a deduction. If you plan on complying with this safe harbor, there are several requirements that must be met, one of which is that 250 hours must be spent on the activity every year and in later years (2022 and beyond) you must spend 250 hours in 3 out of 5 years.

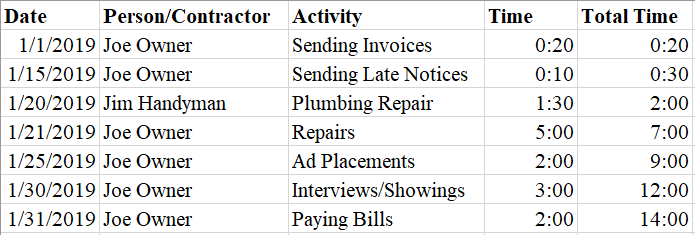

So what is the easiest way to keep track of these hours and how should you do it? You could buy a calendar to jot down information or you could create a simple list in a software like Excel to keep track of this information. Whichever way you choose, you’ll want to note the following:

So what is the easiest way to keep track of these hours and how should you do it? You could buy a calendar to jot down information or you could create a simple list in a software like Excel to keep track of this information. Whichever way you choose, you’ll want to note the following:

- The date work was done

- Who performed the work: this could be you as the owner, an employee or an independent contractor

- What was done: this can be maintenance, repairs, collection of rent, payment of expenses, provision of services to tenants, and time spent trying to rent out the property.

- How much time was spent: this should include all of the time spent on the above activities. Note that you are not allowed to include travel time to and from the property in the 250 hours.

Mileage requires similar contemporaneous logs. A taxpayer can potentially deduct mileage for business, charitable, or medical purposes. For business purposes the taxpayer also has the option to instead deduct actual expenses of the vehicle which can add some additional tracking requirements. To deduct mileage the taxpayer needs to keep track of the date, mileage per trip, and the reason for the trip. To deduct actual expenses the taxpayer needs to keep track of all auto expenses so they can be pro-rated, total personal miles, and total business miles including the details required for the mileage deduction. The personal portion is most easily tracked by keeping track of beginning and ending annual mileage numbers and backing out the business miles from the total for the year.

With the rise of technology, many apps are being created specifically to track mileage. Assuming you always travel with your cell phone you could use an app like Mile IQ or Mileage Tracker to track your miles. Every app varies, as well as the cost, so make sure to do your research before you commit to a specific app.

Meals also require similar tracking. You may have been under the impression that all of your meals are deductible because you talk about your business with the waitress, but that is not the case. Meals must have a business purpose to be deductible and you must keep a log of the business relationship and the person you were meeting with. Depending on how robust your accounting system is, you could record these notes into memo fields of software like QuickBooks or if you are still using a shoebox of receipts, put the note on the back of the pertinent receipts.

While this does not cover all of the records you should be keeping, it should give you an idea of what you need to keep track of and how simple it can be to write down or record the logs. If you have further questions be sure to talk to your accountant.

With the rise of technology, many apps are being created specifically to track mileage. Assuming you always travel with your cell phone you could use an app like Mile IQ or Mileage Tracker to track your miles. Every app varies, as well as the cost, so make sure to do your research before you commit to a specific app.

Meals also require similar tracking. You may have been under the impression that all of your meals are deductible because you talk about your business with the waitress, but that is not the case. Meals must have a business purpose to be deductible and you must keep a log of the business relationship and the person you were meeting with. Depending on how robust your accounting system is, you could record these notes into memo fields of software like QuickBooks or if you are still using a shoebox of receipts, put the note on the back of the pertinent receipts.

While this does not cover all of the records you should be keeping, it should give you an idea of what you need to keep track of and how simple it can be to write down or record the logs. If you have further questions be sure to talk to your accountant.

RSS Feed

RSS Feed