Yesterday, the IRS launched a new Tax Withholding Estimator. The estimator is similar to the previous Withholding Calculator, but is more user-friendly.

The new estimator works best if you have information on hand like your latest paystub and your spouse's information, if applicable. You will also need to be able to estimate unearned income, adjustments, deductions if you itemize, and the amount of tax credits you will receive.

The new estimator also now helps estimate self-employment tax for those who are self-employed.

Other changes include:

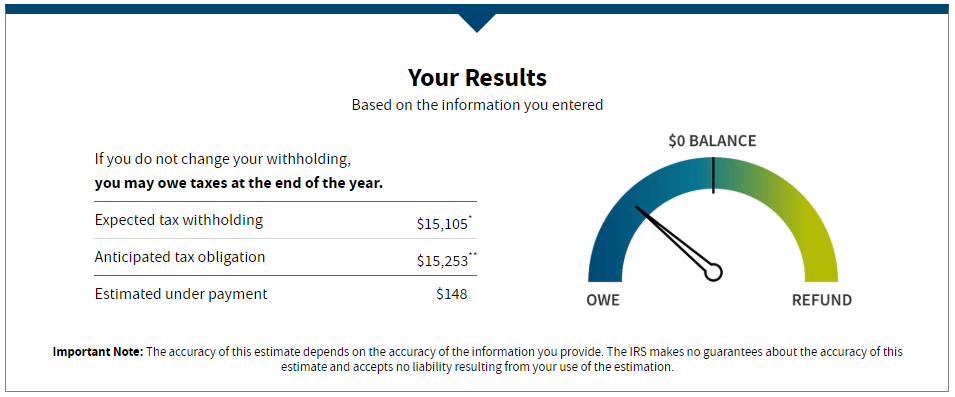

If you use the tracker it provides a summary at the end of how much you will either owe or be refunded. You also will be able to click the option, “Get my balance close to zero” or “I’d like to get a refund” to get information on how to update your W-2. Asking for a refund should result in a refund of $500 or larger based on your inputs.

Here is an example populated from entering random data:

The new estimator also now helps estimate self-employment tax for those who are self-employed.

Other changes include:

- Plain language

- A progress tracker that allows the option of being able to move back and forth between steps

- Calculation of the taxable portion of social security

- Mobile friendly design

If you use the tracker it provides a summary at the end of how much you will either owe or be refunded. You also will be able to click the option, “Get my balance close to zero” or “I’d like to get a refund” to get information on how to update your W-2. Asking for a refund should result in a refund of $500 or larger based on your inputs.

Here is an example populated from entering random data:

If you have any questions on what you should be withholding, be sure to contact your accountant.

RSS Feed

RSS Feed