The IRS recently released an application to check the status of when taxpayers should be receiving their Economic Impact Payments. There are two options, one for taxpayers who filed a tax return in 2018 or 2019 and another for taxpayers who did not file a tax return.

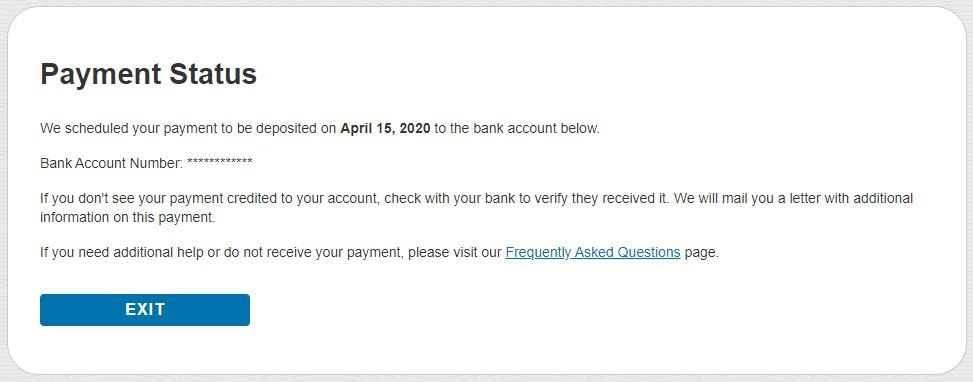

Although the webpage cautions that you may need a 2018 or 2019 tax return the process is fairly simple, you enter your SSN, date of birth, and address used for filing your tax return. If the IRS has a bank account on file you should see a similar message to the below:

If you do not have banking information on file, you may be given the opportunity to enter banking information if a check has not yet been mailed.

Keep in mind, some checks have already been mailed and many taxpayers with direct deposit on file have been receiving their payments on April 15th (today!) so you may want to check your bank account too.

You can always contact your accountant with any questions.

Keep in mind, some checks have already been mailed and many taxpayers with direct deposit on file have been receiving their payments on April 15th (today!) so you may want to check your bank account too.

You can always contact your accountant with any questions.

RSS Feed

RSS Feed