Alyssa Hodges, CPA •

Itemized Deductions have changed considerably due to the Tax Cuts and Jobs Act of 2017. Since the standard deduction has nearly doubled, less people than ever before are going to be itemizing deductions. However, if you are right on the cuff, you may be able to implement a tax strategy called “bunching” to continue to take advantage of itemized deductions.

Itemized Deductions have changed considerably due to the Tax Cuts and Jobs Act of 2017. Since the standard deduction has nearly doubled, less people than ever before are going to be itemizing deductions. However, if you are right on the cuff, you may be able to implement a tax strategy called “bunching” to continue to take advantage of itemized deductions.

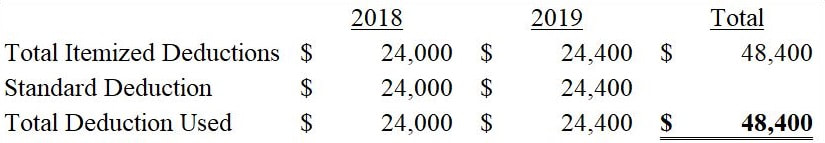

The following is a condensed example for a set of married filing jointly tax payers, Mr. and Mrs. Rich (fictional people):

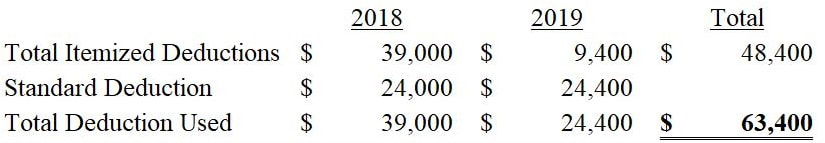

Mr. and Mrs. Rich are charitably inclined and donate $15,000 to their favorite charities every year which encompasses the majority of their deductions. In 2018 they decide they will accelerate their 2019 donations:

By moving up their charitable contributions, total cash paid for itemized deductions is the same over two years but the total deduction has increased by $15,000. The more a taxpayer can move from one year to the next, the greater the benefit will be for itemized bunching.

Itemized bunching works successfully if taxpayers are close to the threshold for using the standard deduction and have the ability to prepay or defer expenses. Going forwards, the most benefit will likely be seen with charitable donations such as in the example above because taxes are now subject to a $10,000 limit. It is still possible to accelerate or defer tax payments, but if you pay $8,000 in property tax per year, you would only benefit from accelerating $2,000 of the follow year’s payment.

Another important consideration for itemized bunching is whether you will be in a higher tax bracket in a particular year. Considering the above example, if Mr. and Mrs. Rich have a marginal tax rate of 32% in 2018 and 24% in 2019 they will save an additional $1,200 by using itemized bunching in the year with the higher rate.

If you are in AMT (the “alternative minimum tax”) these strategies may not work for you. Please call us if you have any questions or want to consider the impacts of itemized bunching on your tax return.

Itemized bunching works successfully if taxpayers are close to the threshold for using the standard deduction and have the ability to prepay or defer expenses. Going forwards, the most benefit will likely be seen with charitable donations such as in the example above because taxes are now subject to a $10,000 limit. It is still possible to accelerate or defer tax payments, but if you pay $8,000 in property tax per year, you would only benefit from accelerating $2,000 of the follow year’s payment.

Another important consideration for itemized bunching is whether you will be in a higher tax bracket in a particular year. Considering the above example, if Mr. and Mrs. Rich have a marginal tax rate of 32% in 2018 and 24% in 2019 they will save an additional $1,200 by using itemized bunching in the year with the higher rate.

If you are in AMT (the “alternative minimum tax”) these strategies may not work for you. Please call us if you have any questions or want to consider the impacts of itemized bunching on your tax return.

RSS Feed

RSS Feed