Dana Bull, CPA •

Age 62. The magic age at which you become eligible to start receiving social security benefits. But should you? There are many complexities when it comes to Social Security and understanding the rules for collecting Social Security can help you take advantage of the retirement benefits to which you are entitled. I will outline some of the considerations for when to begin receiving Social Security benefits.

Age 62. The magic age at which you become eligible to start receiving social security benefits. But should you? There are many complexities when it comes to Social Security and understanding the rules for collecting Social Security can help you take advantage of the retirement benefits to which you are entitled. I will outline some of the considerations for when to begin receiving Social Security benefits.

Age is important! Regardless of your birth year, anyone who is eligible for Social Security can start taking reduced benefits at age 62.

Full retirement age (FRA). Also called “normal retirement age”, FRA is the age you become eligible for full Social Security benefits. Traditionally, the normal retirement age has been 65. This changed as part of the Social Security Amendments of 1983 and gradually increased for people born in 1938 or later, until it reached 67 for all people born after 1959.

Delayed retirement age. Eligible individuals must start taking benefits at age 70. Your benefits will increase each year if you delay taking retirement benefits later than your FRA.

In the case of early retirement (between ages 62-66 for those born after 1938) your benefit is reduced 5/9ths of one percent for each month before normal retirement age, plus an additional 5/12ths of one percent over 36 months. In round numbers that means if you choose to begin receiving Social Security benefits at age 62 you will only receive approximately 70% of your full benefit. For example if your full benefit at age 67 would be $2,000 per month and you begin receiving benefits at age 62 you will only receive $1,400 per month.

You are not required to begin taking distributions at your full retirement age. If you have other sources of income or want to continue to work past FRA your benefit will be increased by 8% per year. That means if you wait until you are age 70, you would receive 124% of your full benefit. Using our prior example your $2,000 full monthly benefit would be increased to $2,480.

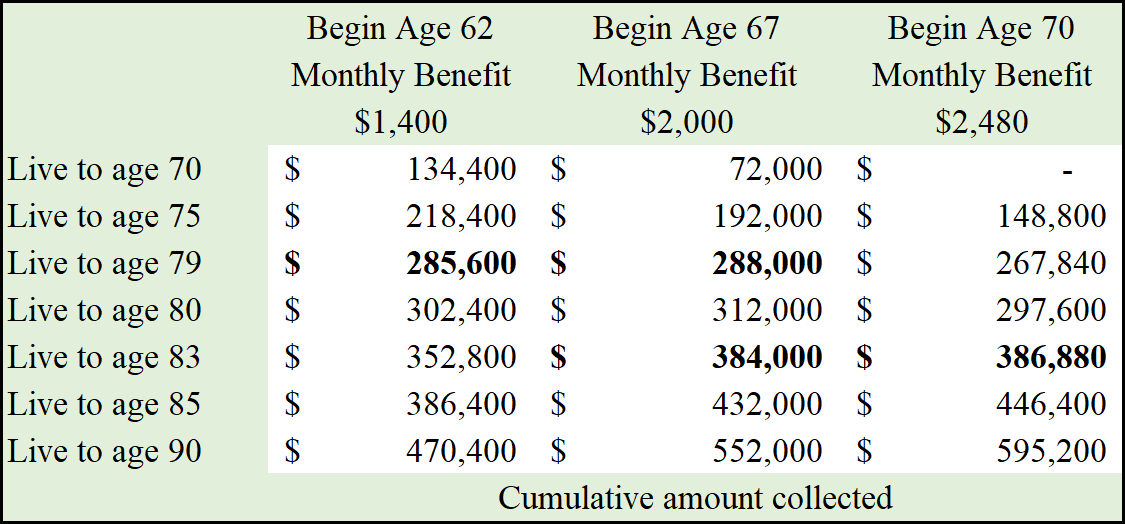

As you can see there is a significant difference in the monthly benefit comparing early vs. delayed retirement. But is it worth delaying? The following break-even analysis for someone with a FRA of 67 shows how long you have to live to increase your overall benefit if you choose to delay:

Full retirement age (FRA). Also called “normal retirement age”, FRA is the age you become eligible for full Social Security benefits. Traditionally, the normal retirement age has been 65. This changed as part of the Social Security Amendments of 1983 and gradually increased for people born in 1938 or later, until it reached 67 for all people born after 1959.

Delayed retirement age. Eligible individuals must start taking benefits at age 70. Your benefits will increase each year if you delay taking retirement benefits later than your FRA.

In the case of early retirement (between ages 62-66 for those born after 1938) your benefit is reduced 5/9ths of one percent for each month before normal retirement age, plus an additional 5/12ths of one percent over 36 months. In round numbers that means if you choose to begin receiving Social Security benefits at age 62 you will only receive approximately 70% of your full benefit. For example if your full benefit at age 67 would be $2,000 per month and you begin receiving benefits at age 62 you will only receive $1,400 per month.

You are not required to begin taking distributions at your full retirement age. If you have other sources of income or want to continue to work past FRA your benefit will be increased by 8% per year. That means if you wait until you are age 70, you would receive 124% of your full benefit. Using our prior example your $2,000 full monthly benefit would be increased to $2,480.

As you can see there is a significant difference in the monthly benefit comparing early vs. delayed retirement. But is it worth delaying? The following break-even analysis for someone with a FRA of 67 shows how long you have to live to increase your overall benefit if you choose to delay:

As these numbers show, if you begin at age 67, you will need live beyond age 79 to begin to see the benefit of waiting until FRA. If you choose to begin at age 70 you would need to live to age 83 to reap the benefits of the larger monthly check.

Since there are many nuances to claiming Social Security, understanding how your benefits are calculated is necessary to maximize your retirement income. Other considerations such as your longevity expectations, potential health care needs and other sources of income in retirement are also likely to impact your plans for taking Social Security.

The Social Security Administration has numerous calculators (including this life expectancy calculator) designed to help you make informed decisions on your options for Social Security benefits. Be sure to visit the website.

If you are interested in getting more exact numbers for your specific benefits you can set up an account to view your actual account and expected benefits.

As always feel free to contact us if you have any questions.

Since there are many nuances to claiming Social Security, understanding how your benefits are calculated is necessary to maximize your retirement income. Other considerations such as your longevity expectations, potential health care needs and other sources of income in retirement are also likely to impact your plans for taking Social Security.

The Social Security Administration has numerous calculators (including this life expectancy calculator) designed to help you make informed decisions on your options for Social Security benefits. Be sure to visit the website.

If you are interested in getting more exact numbers for your specific benefits you can set up an account to view your actual account and expected benefits.

As always feel free to contact us if you have any questions.

RSS Feed

RSS Feed