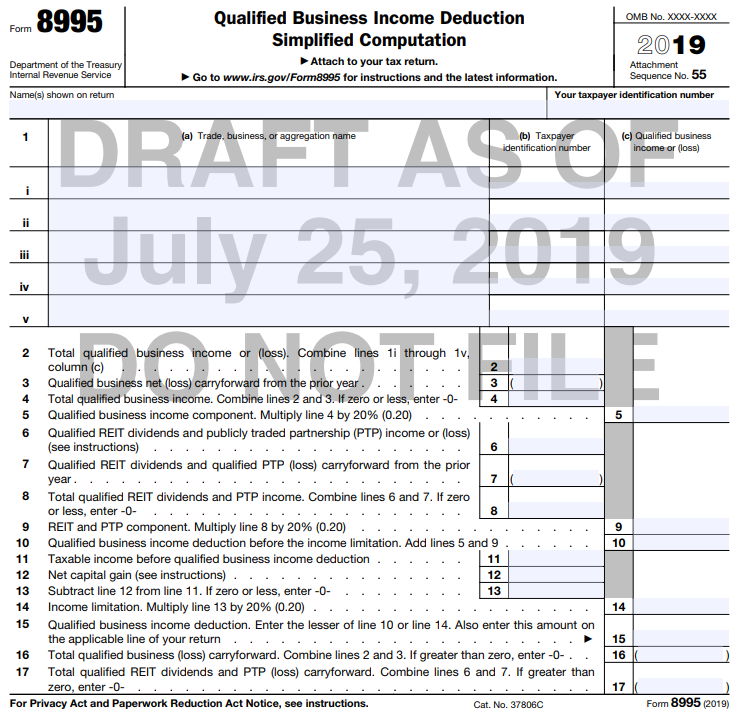

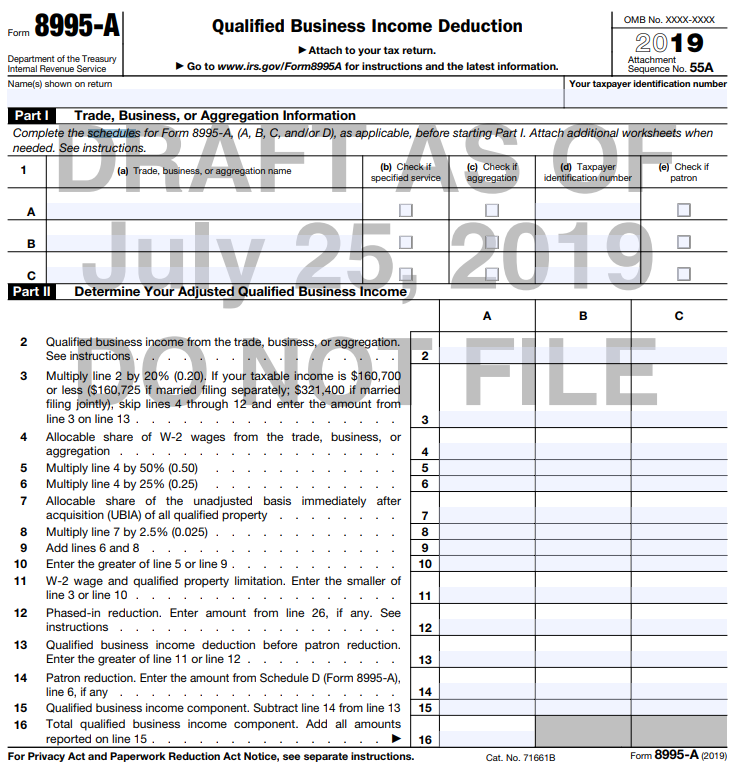

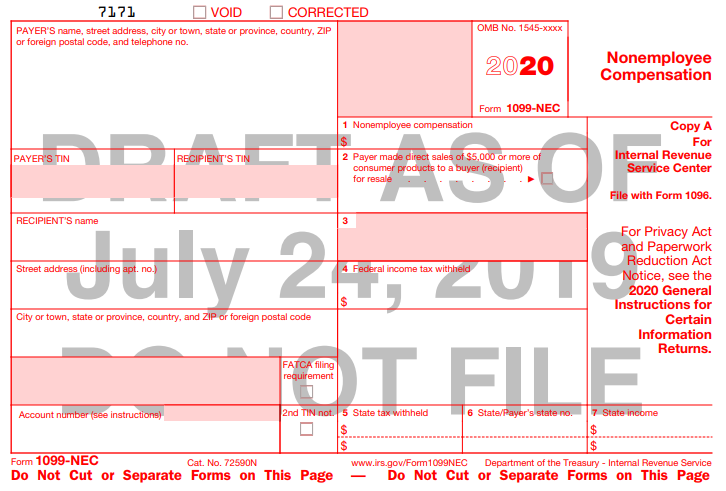

The IRS recently released new draft tax forms for 2019 and 2020. New for 2019 are Form 8995, Form 8995-A, and corresponding schedules. These forms are used for the Qualified Business Income Deduction which was new in 2018. New in 2020 is Form 1099-NEC which will be used instead of 1099-MISC to report nonemployee compensation.

In 2019 Form 8995, Qualified Business Income Deduction Simplified Calculation, will be used when taxable income is below the phase-out range for the deduction so a more simplified calculation is able to be used.

In 2019 Form 8995-A, Qualified Business Income Deduction, will be used when taxable income is in or above the phase-out range for the deduction. This form also has at least two schedules, but likely there will be four in total. At this point, the draft forms that have been released include Schedule A: Specified Service Trades or Businesses and Schedule D: Special Rules for Patrons of Agricultural or Horticultural Cooperatives.

Also newly released is draft Form 1099-NEC for 2020. This form will be used to report nonemployee compensation in lieu of reporting the information on Form 1099-MISC. This form is likely being created separately from 1099-MISC because nonemployee compensation must be reported by January 31 whereas other payments on Form 1099-MISC do not need to be remitted until March 31. In 2019 nonemployee compensation will continue to be reported using Form 1099-MISC.

Keep in mind that these are draft forms and could change. Final forms will be posted at a later date. To see the new forms and schedules, check out the IRS’ Draft Tax Forms website.

RSS Feed

RSS Feed