As we approach the last quarter of 2020, now is a good time to take a look at your withholdings and find out whether you are having enough taxes withheld from your paycheck. The IRS requires 100% of prior year tax (110% for adjusted gross income over $150,00) or 90% of current year tax to be withheld throughout the year. By adjusting your withholdings before the end of the year you can avoid underpayment penalties in April.

The IRS has a Tax Withholding Estimator that you can use to estimate whether your withholdings are accurate.

The estimator works best if you have information on hand like your latest paystub and your spouse's similar information, if applicable. You will also need to be able to estimate unearned income, adjustments, deductions if you itemize, and the amount of tax credits you will receive.

The estimator also now helps estimate self-employment tax for those who are self-employed.

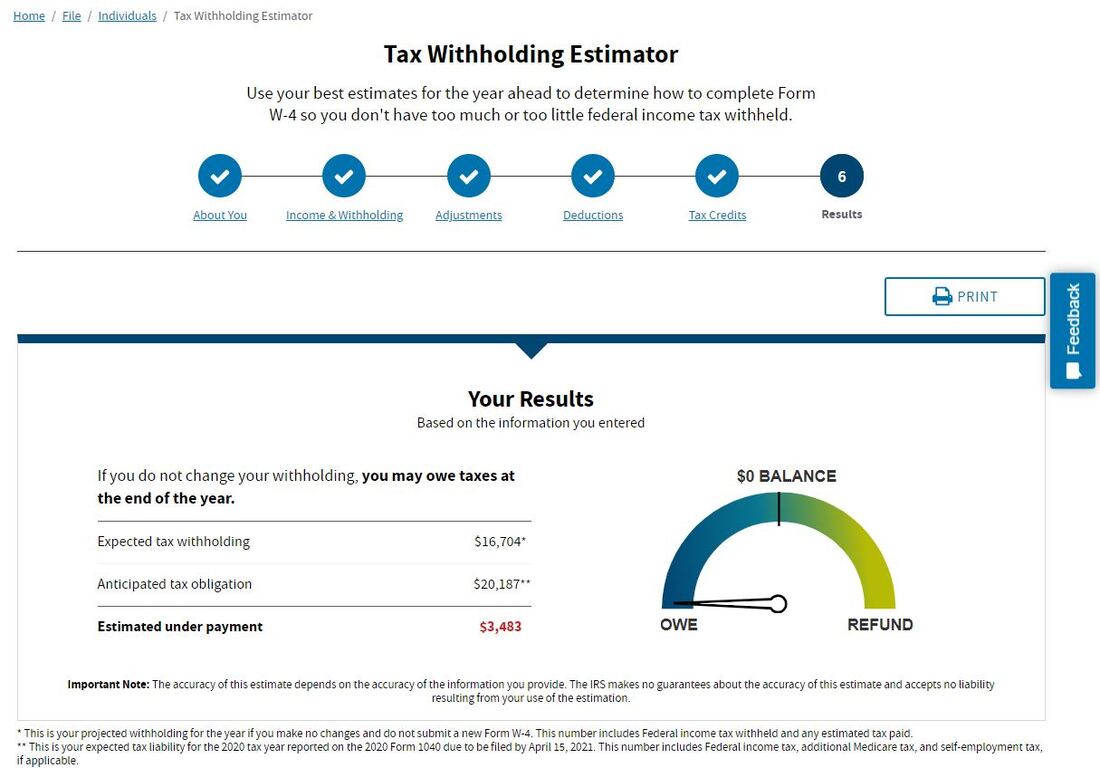

If you use the tracker it provides a summary at the end of how much you will either owe or be refunded. Here is an example populated from entering random data:

The estimator works best if you have information on hand like your latest paystub and your spouse's similar information, if applicable. You will also need to be able to estimate unearned income, adjustments, deductions if you itemize, and the amount of tax credits you will receive.

The estimator also now helps estimate self-employment tax for those who are self-employed.

If you use the tracker it provides a summary at the end of how much you will either owe or be refunded. Here is an example populated from entering random data:

After generating your results you have the option to adjust your results to avoid owing a balance. Note that there is no option to owe a small amount. You can adjust from a refund of $0 to a refund of up to $5,000. To generate a new Form W-4, you can expand the button on how to adjust your withholding by clicking the circle with the plus in the middle. Then, by clicking the link that says Form W-4 you can print out a new W-4 for both you and your spouse (if applicable) that is already pre-populated with adjusted withholding amounts.

Be careful with this new Form W-4. This form is prepared to adjust your withholdings for the remainder of the current year. You will likely want different withholdings for the full 2021 year so you will most likely need to prepare a new form in January.

If your tax situation is not straight-forward you may want to have your accountant do a more thorough tax planning scenario for you. We are always happy to connect and do tax planning to get an idea of how your taxes will look in April and help to adjust your withholdings or estimates while you still have time to make changes.

Did you like our post? Follow our page on LinkedIn to stay up to date on all of our blog posts.

Be careful with this new Form W-4. This form is prepared to adjust your withholdings for the remainder of the current year. You will likely want different withholdings for the full 2021 year so you will most likely need to prepare a new form in January.

If your tax situation is not straight-forward you may want to have your accountant do a more thorough tax planning scenario for you. We are always happy to connect and do tax planning to get an idea of how your taxes will look in April and help to adjust your withholdings or estimates while you still have time to make changes.

Did you like our post? Follow our page on LinkedIn to stay up to date on all of our blog posts.

RSS Feed

RSS Feed