With inflation running at 30 year highs the IRS has been busy updating various items that are tied to inflation. On October 21, 2022, the Internal Revenue Service issued Notice 2022-55 announcing retirement plan cost-of-living adjustments (COLAs) applicable to 2023.

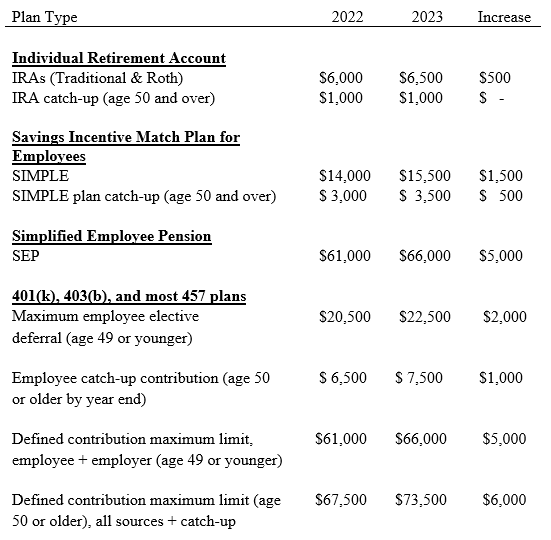

After several years without an increase to the traditional and Roth individual retirement account (IRA) regular contribution limit, there will be a $500 increase for 2023. Those limits as well as simplified employee pension (SEP) limits, elective deferral limits, and Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) IRA deferral limits for 2023 are as follows:

RSS Feed

RSS Feed