Shauna Ferguson, CPA •

At what age do you have to start taking required minimum distributions (RMDs) from your IRA or retirement plan (401K or 403(b))?

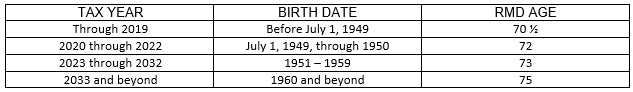

Have you heard about the Setting up Every Community for Retirement Enhancement (SECURE ACT) tax legislation? Effective January 1, 2020, the SECURE 1.0 Act raised the minimum age for RMDs from 70 ½ to 72. But wait… that’s not all; then came along SECURE 2.0 which raised the age required to start your RMDs to 73 years of age, beginning on January 1, 2023. The RMD age is again being raised on January 1, 2033 to 75 years.

At what age do you have to start taking required minimum distributions (RMDs) from your IRA or retirement plan (401K or 403(b))?

Have you heard about the Setting up Every Community for Retirement Enhancement (SECURE ACT) tax legislation? Effective January 1, 2020, the SECURE 1.0 Act raised the minimum age for RMDs from 70 ½ to 72. But wait… that’s not all; then came along SECURE 2.0 which raised the age required to start your RMDs to 73 years of age, beginning on January 1, 2023. The RMD age is again being raised on January 1, 2033 to 75 years.

If you are still employed and do not own more than 5% of the business you work for, you do not have to take a RMD from your current 401(k) or 403 (b), regardless of your age, as long as your employer doesn’t require it! This is not the case for your IRAs.

The new SECURE 2.0 provision applies to distributions required to be made after December 31, 2022, for individuals who attain age 72 after that date.

The new SECURE 2.0 provision applies to distributions required to be made after December 31, 2022, for individuals who attain age 72 after that date.

If you turned 73 years old in 2024 you will be required to begin taking your RMDs. News flash: you do not have to actually take the distribution until April 1, 2025. If you do not take a distribution in 2024 and wait until April 1, 2025, you will then have to take a second RMD before December 31, 2025.

As of January 1, 2024, RMDs will no longer be required from Roth accounts in employer retirement plans. You must still take the RMDs from Roth accounts in a 401(k) or 403(b) plan for 2023, including those with a required beginning date of April 1, 2024. RMDs are not required from Roth IRAs.

Also, as part of the Secure Act 2.0, 529 Plans which are used for educational purposes also now have the ability to be rolled into a Roth IRA, check out our blog post on that topic to learn more.

If you have any questions, please reach out to Mason+Rich at 603-224-2000.

As of January 1, 2024, RMDs will no longer be required from Roth accounts in employer retirement plans. You must still take the RMDs from Roth accounts in a 401(k) or 403(b) plan for 2023, including those with a required beginning date of April 1, 2024. RMDs are not required from Roth IRAs.

Also, as part of the Secure Act 2.0, 529 Plans which are used for educational purposes also now have the ability to be rolled into a Roth IRA, check out our blog post on that topic to learn more.

If you have any questions, please reach out to Mason+Rich at 603-224-2000.

RSS Feed

RSS Feed