Mallory Vincent, MBA •

With the holiday season approaching, tis the season for spreading kindness and being charitable. During the coronavirus pandemic, even more people and animals are in need, but many not-for-profits are struggling. By making a donation and giving a gift to charity, you are helping out others and spreading holiday cheer. This act of kindness could also be a great tax write-off, and in 2021 everyone will be eligible to receive a charity tax deduction on their tax return. Read on to learn some tips on how to make your donation count as a tax benefit on your 2021 tax return.

With the holiday season approaching, tis the season for spreading kindness and being charitable. During the coronavirus pandemic, even more people and animals are in need, but many not-for-profits are struggling. By making a donation and giving a gift to charity, you are helping out others and spreading holiday cheer. This act of kindness could also be a great tax write-off, and in 2021 everyone will be eligible to receive a charity tax deduction on their tax return. Read on to learn some tips on how to make your donation count as a tax benefit on your 2021 tax return.

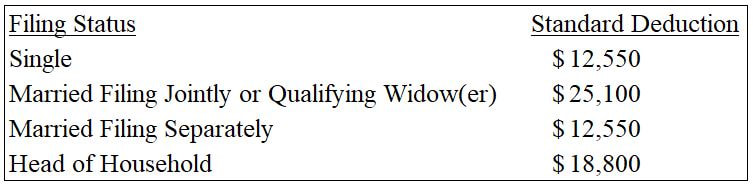

You may be thinking that this does not apply to you because you usually take the standard deduction rather than itemizing deductions on Schedule A of your tax return. Taxpayers can either itemize or take the standard deduction, not both (with the exception of a new rule for 2021 only noted below). So the goal is for your gifts to charity plus other eligible itemized deductions you paid (mortgage interest, taxes, medical and dental expenses, etc.) to exceed the standard deduction for your filing status. Here are the 2021 standard deduction amounts for each filing status:

If you typically take the standard deduction, have you considered bunching the charitable donations that you usually give to others over multiple years into 2021 so that you can itemize your deductions in 2021?

Maybe you are not able to donate a large amount of your disposable income and are not able to itemize your deductions, but have a few hundred dollars or less available to make a charitable donation instead. There is a new tax rule, applicable only in 2021 that you can take advantage of even if you do not itemize deductions. Yes, you read this right. If you are going to be taking the standard deduction in 2021, you can claim an above-the-line deduction of up to $600 (married filing joint) or $300 (single/married filing separately) if you make cash contributions to eligible charitable organizations on or before December 31, 2021. For additional details, see IRS News Release 2021-214.

What this means is that you can take both the standard deduction and an additional deduction for up to $600 on your 2021 tax return. Be aware that for your cash contribution to count for this 2021 only tax benefit, you must give to an IRS-recognized section 501(c)(3) charitable organization. To verify if an organization you are considering donating to is eligible for a tax write-off, you can use the IRS’s online “Tax Exempt Organization Tool”.

For those of you who are able to bunch contributions into 2021 or earned a higher income in 2021 and are eligible to itemize deductions and have made charitable contributions, you may be concerned about the 60% of AGI limit on charitable gifts of cash. This rule has been raised to 100% but the relief only applies to cash contributions made in 2021 and deducted on Schedule A. In addition, giving beyond the 100% AGI limitation may be carried over and used in the next five years, but the enhanced deduction expires after 2021. In other words, what this means is that if you have been considering a large cash gift to charity, this is the year to do it. Keep in mind that gifts to donor-advised funds and private non-operating foundations are excluded from this new tax rule. In addition, carryovers of excess charitable contributions from prior years do not get this tax break.

Lastly, another tip to boost your deduction is to consider donating valuable property or contributing appreciated investments, such as stocks or shares in mutual funds. As long as you have owned the property greater than a year, then you will usually be able to write off the current fair market value, if you itemize your deductions. However, with the market constantly changing, keep in mind that it is not recommended to donate property that has declined in value since you acquired it.

Contact your accountant with any questions and remember to follow us on LinkedIn to stay up to date on all of our posts.

Maybe you are not able to donate a large amount of your disposable income and are not able to itemize your deductions, but have a few hundred dollars or less available to make a charitable donation instead. There is a new tax rule, applicable only in 2021 that you can take advantage of even if you do not itemize deductions. Yes, you read this right. If you are going to be taking the standard deduction in 2021, you can claim an above-the-line deduction of up to $600 (married filing joint) or $300 (single/married filing separately) if you make cash contributions to eligible charitable organizations on or before December 31, 2021. For additional details, see IRS News Release 2021-214.

What this means is that you can take both the standard deduction and an additional deduction for up to $600 on your 2021 tax return. Be aware that for your cash contribution to count for this 2021 only tax benefit, you must give to an IRS-recognized section 501(c)(3) charitable organization. To verify if an organization you are considering donating to is eligible for a tax write-off, you can use the IRS’s online “Tax Exempt Organization Tool”.

For those of you who are able to bunch contributions into 2021 or earned a higher income in 2021 and are eligible to itemize deductions and have made charitable contributions, you may be concerned about the 60% of AGI limit on charitable gifts of cash. This rule has been raised to 100% but the relief only applies to cash contributions made in 2021 and deducted on Schedule A. In addition, giving beyond the 100% AGI limitation may be carried over and used in the next five years, but the enhanced deduction expires after 2021. In other words, what this means is that if you have been considering a large cash gift to charity, this is the year to do it. Keep in mind that gifts to donor-advised funds and private non-operating foundations are excluded from this new tax rule. In addition, carryovers of excess charitable contributions from prior years do not get this tax break.

Lastly, another tip to boost your deduction is to consider donating valuable property or contributing appreciated investments, such as stocks or shares in mutual funds. As long as you have owned the property greater than a year, then you will usually be able to write off the current fair market value, if you itemize your deductions. However, with the market constantly changing, keep in mind that it is not recommended to donate property that has declined in value since you acquired it.

Contact your accountant with any questions and remember to follow us on LinkedIn to stay up to date on all of our posts.

RSS Feed

RSS Feed