Anthony McVeigh •

Recently, the Supreme Court ruled that the government is unable to cancel student loan debt. This is disappointing to many Americans, however, there are other plans in the works to provide loan debt relief to students. Read on to learn more about what is currently in the works as a result of this decision.

Recently, the Supreme Court ruled that the government is unable to cancel student loan debt. This is disappointing to many Americans, however, there are other plans in the works to provide loan debt relief to students. Read on to learn more about what is currently in the works as a result of this decision.

President Joe Biden is launching another effort to try and forgive certain federal student loans. This new approach is modelled on the Higher Education Act (HEA) of 1965, which permits the U.S. Education Department the ability to compromise or waive student loans backed by the government. This will face legal opposition, so this is not something to rely on, but it is President Joe Biden’s plan B for forgiving student loans.

Currently, there are 190,700 student loan borrowers that live in New Hampshire and collectively they currently owe $6.5 billion in student loans. The average student loan balance per student is $34,085 and 59% of loan holders are under the age of 35. With the student loans not being forgiven, this greatly affects the younger population of New Hampshire.

With the Supreme Court ruling, the longstanding federal student loan payment pause will expire this fall. Interest will begin accruing on September 1 and borrowers will need to either begin or resume making payments in October. Unfortunately, the payment pause extensions are not continuing due to a provision in the debt ceiling deal passed by Congress on June 2. However, in response to this, Biden has announced a 12-month transition period for borrowers unable to make monthly payments. If borrowers miss payments, they won’t fall into default, though interest will still accrue during this time.

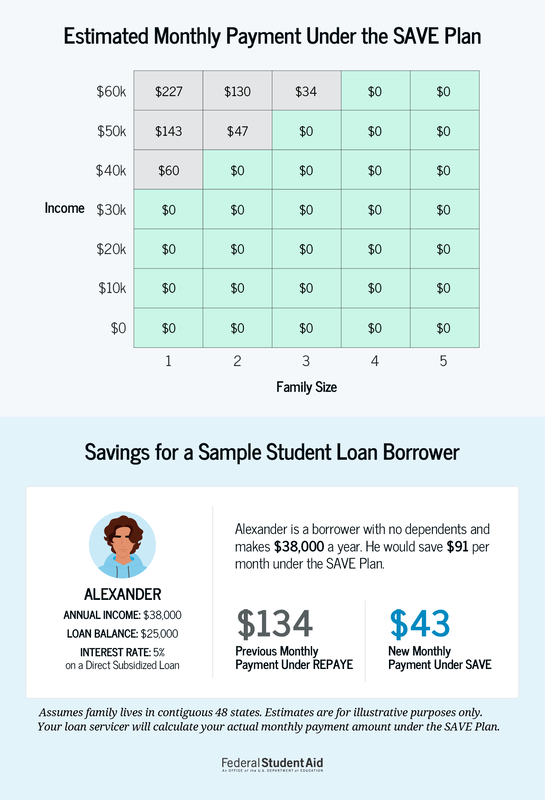

Another effort that the government is putting forward is called the “Saving on A Valuable Education” or “SAVE” repayment plan, and it calculates your monthly payments based on your income and family size.

Under the SAVE Plan, the monthly payment amount is based on your adjusted gross income (AGI) and the U.S. Department of Health and Human Services Poverty Guideline. The SAVE Plan has increased the income exception from 150% to 225% of the poverty line. This means that if you are single and make less than $32,800 or a family of four making less than $67,500 then you would not owe monthly loan payments. In that case your monthly loan payment is $0 until you need to recertify again in a year. When you recertify, your income will be recalculated and if your family size has changed. If these change, your monthly payments may change. If your monthly payment is $0, that payment of $0 still counts toward loan forgiveness.

The forgiveness timing depends on the size of loan and type of degree obtained. If the loan is less than $12,000, then the loan will be fully forgiven in 10 years regardless of the type of degree. If the loan amount is greater than $12,000, then the forgiveness for undergraduate degrees occurs after 20 years of monthly payments and for graduate degrees occurs after 25 years of payments. This program will be fully in place by July 2024.

Below is a diagram provided by Federal Student Aid as an example of what the estimated monthly payments would be in this program.

Currently, there are 190,700 student loan borrowers that live in New Hampshire and collectively they currently owe $6.5 billion in student loans. The average student loan balance per student is $34,085 and 59% of loan holders are under the age of 35. With the student loans not being forgiven, this greatly affects the younger population of New Hampshire.

With the Supreme Court ruling, the longstanding federal student loan payment pause will expire this fall. Interest will begin accruing on September 1 and borrowers will need to either begin or resume making payments in October. Unfortunately, the payment pause extensions are not continuing due to a provision in the debt ceiling deal passed by Congress on June 2. However, in response to this, Biden has announced a 12-month transition period for borrowers unable to make monthly payments. If borrowers miss payments, they won’t fall into default, though interest will still accrue during this time.

Another effort that the government is putting forward is called the “Saving on A Valuable Education” or “SAVE” repayment plan, and it calculates your monthly payments based on your income and family size.

Under the SAVE Plan, the monthly payment amount is based on your adjusted gross income (AGI) and the U.S. Department of Health and Human Services Poverty Guideline. The SAVE Plan has increased the income exception from 150% to 225% of the poverty line. This means that if you are single and make less than $32,800 or a family of four making less than $67,500 then you would not owe monthly loan payments. In that case your monthly loan payment is $0 until you need to recertify again in a year. When you recertify, your income will be recalculated and if your family size has changed. If these change, your monthly payments may change. If your monthly payment is $0, that payment of $0 still counts toward loan forgiveness.

The forgiveness timing depends on the size of loan and type of degree obtained. If the loan is less than $12,000, then the loan will be fully forgiven in 10 years regardless of the type of degree. If the loan amount is greater than $12,000, then the forgiveness for undergraduate degrees occurs after 20 years of monthly payments and for graduate degrees occurs after 25 years of payments. This program will be fully in place by July 2024.

Below is a diagram provided by Federal Student Aid as an example of what the estimated monthly payments would be in this program.

It is important to remember to start planning for repayment of student loans or loans in general as this affects your credit score and will affect future loans you may want to take out. If you are in need of tax planning please contact Mason & Rich and we may be able to provide guidance depending on your situation.

RSS Feed

RSS Feed