In an update to a recent blog post, the IRS has now sent out most of the Advance Child Credit Letters to taxpayers that received advanced child tax credit payments. It is important to note that taxpayers that file as married filing jointly will each receive an Advance Child Tax Credit Letter. Each letter will report a portion of the total amount. In many instances each letter will report half of the total amount, but there are situations where the amounts will be different, so it is important to provide the total amount that was received to your accountant.

The advance child tax credit payment amounts received are needed to reconcile the total child tax credit available to claim on your tax return. If the total amount you report as received on your tax return does not match the IRS records, your return will need additional review by the IRS and your refund will be delayed. This delay will also occur if you report the third Economic Income Payment received that does not match IRS records. With the IRS experiencing unprecedented delays in processing tax returns the best way to get your refund quickly is to provide complete and accurate information to your accountant and electronically file requesting direct deposit of your refund. You can read it directly from the IRS here.

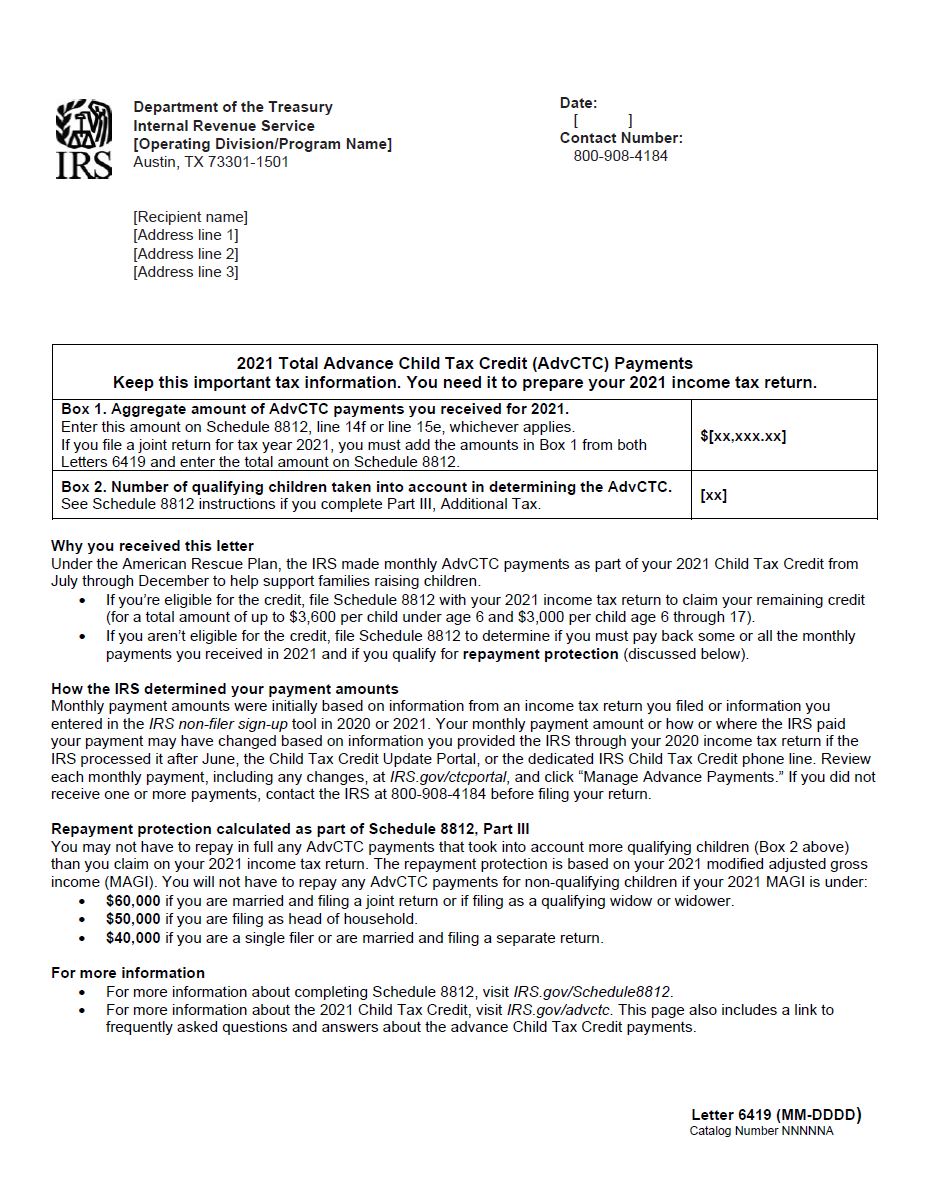

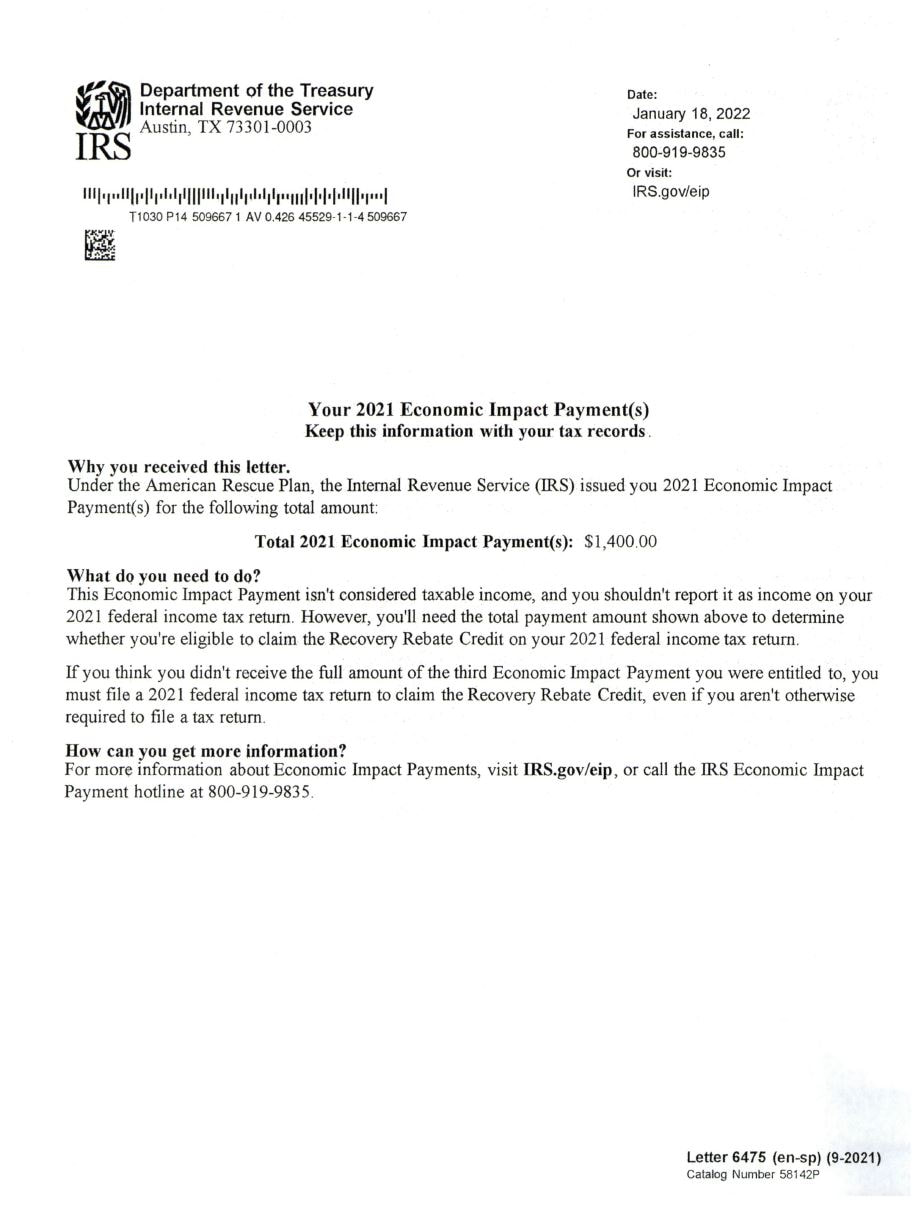

Not sure what the letters will look like? We have examples for you, below!

Letter 6419: Advance Child Tax Credit

Not sure what the letters will look like? We have examples for you, below!

Letter 6419: Advance Child Tax Credit

Letter 6475: 2021 Economic Impact Payment(s)

If you have additional questions reach out to your accountant. Remember to follow us on LinkedIn to stay up-to-date on all of our posts.

RSS Feed

RSS Feed