Brendon Landi •

As COVID-19 benefits provided to taxpayers and businesses are being phased out, one particular change may take some business owners by surprise. In 2021, the Consolidated Appropriations Act provided temporary increased deductibility of certain business meal expenses for 2021 and 2022. However, as we have now moved out of this temporary time frame, the deductibility of meals and entertainment return to pre-2021 regulations set forth by the Tax Cuts and Jobs Act of 2018. Now I’m sure you’re asking yourself, “Well what can I deduct?” The answer to this question actually depends on the circumstances.

As COVID-19 benefits provided to taxpayers and businesses are being phased out, one particular change may take some business owners by surprise. In 2021, the Consolidated Appropriations Act provided temporary increased deductibility of certain business meal expenses for 2021 and 2022. However, as we have now moved out of this temporary time frame, the deductibility of meals and entertainment return to pre-2021 regulations set forth by the Tax Cuts and Jobs Act of 2018. Now I’m sure you’re asking yourself, “Well what can I deduct?” The answer to this question actually depends on the circumstances.

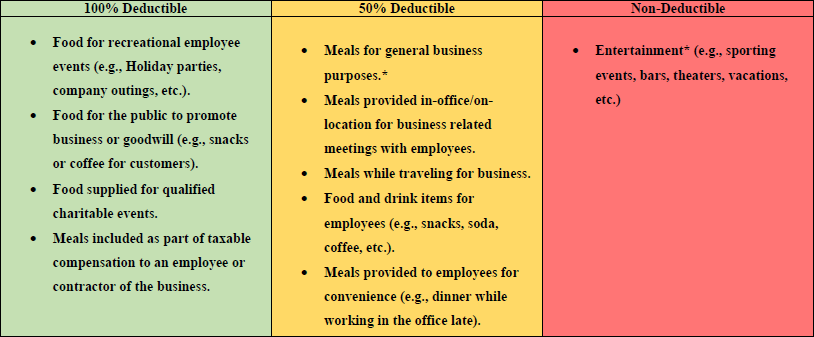

Here are some general guidelines that can assist in determining your deductibility:

Exceptions and Limitations

As with anything, there are some exceptions and limitations to what is and is not tax deductible. However, in all cases, any meals cannot be considered “lavish or extravagant” relative to the business standard. Generally speaking, the meals don’t necessarily need to be from your local fast food joint, but in most cases, you may want to avoid that Michelin star restaurant.

When having a meal as part of your business, the meal can only be deducted if a representative of the business (employee or business taxpayer) is present at the meal with a client. When you have these meals, you may also want to consider leaving any additional guests (e.g., spouse and children) out since their meals are not deductible.

Generally speaking, entertainment expenses are not considered to be deductible unless your business is unable to actively operate without these expenses, such as a comedy bar.

Alternatives

In lieu of tracking your deductions for business travel meals and other travel expenses for your business, you could alternately use the IRS’s per diem standard rates for business travel. The per diem option would be an allowance paid to your employee for lodging, meals, and incidental expenses incurred while traveling for business. The allowance is paid in lieu of paying their actual travel expenses. It is worth noting that the usage of per diem allowances does not supersede the 50% deduction limitation. As such, only 50% of the per diem allowance for meals is considered deductible.

Depending on where in the continental U.S. you (or your employee) are traveling for work, there may be a different per diem rate that would need to be used. The rate for the area of travel can be found here.

Requirements

If you plan on deducting any meal or entertainment expenses, or using a per diem rate, there are certain record keeping requirements that need to be met. To best protect your business, any meals an entertainment expenses should be recorded with the following information as well as having a corresponding receipt (See our Contemporaneous Documentation Blog Post):

- Date of the meal

- Purpose of the business meal

- Persons attending

- Name of the Venue

- Total of the bill, including tax and tip.

If you are using per diem rates, the IRS requires that any employee given a per diem allowance submits an expense report within with their business/employer which includes:

- The business purpose of the trip.

- The date, place, and amount of the trip, and

- Receipts for lodging (if using the meals-only per diem rate)

Keep in mind however that these per diem payments are considered taxable if:

- An expense report is not filed.

- An expense report filed does not include the date, time, place, amount, and business purpose of the expense.

- A flat amount is given to the employee and no expense report is required, or

- Per diem is paid in excess of the allowable standard federal rate.

If a per diem payment is considered to be taxable, it should be treated as wages, which would include taxes owed from both the employee and employer.

As always, you should keep detailed records of any expenses, whether being taken as a deduction or using per diem rates, as this can save you a huge headache in the case the IRS decides to knock on your door with an audit.

Our accountants at Mason + Rich are ready to help you with navigating your deductions! Feel free to call us at 603-224-2000.

RSS Feed

RSS Feed