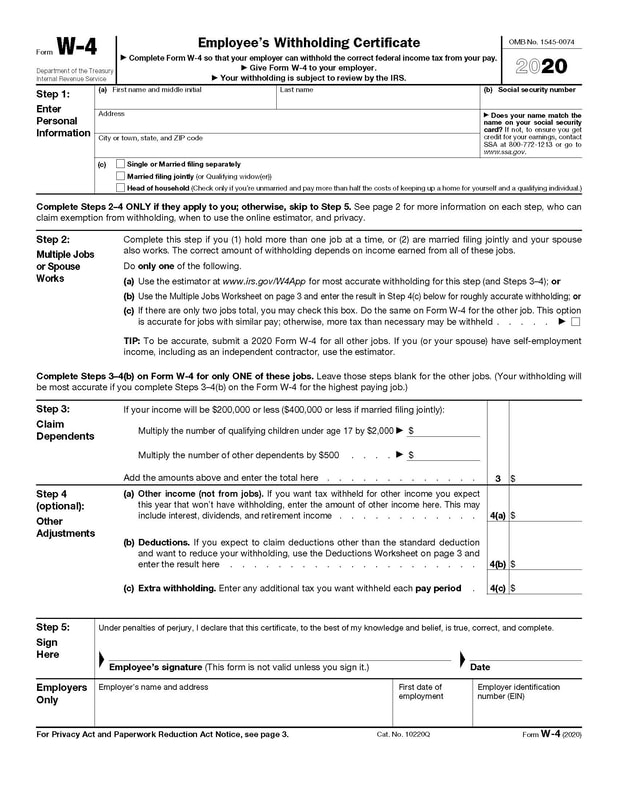

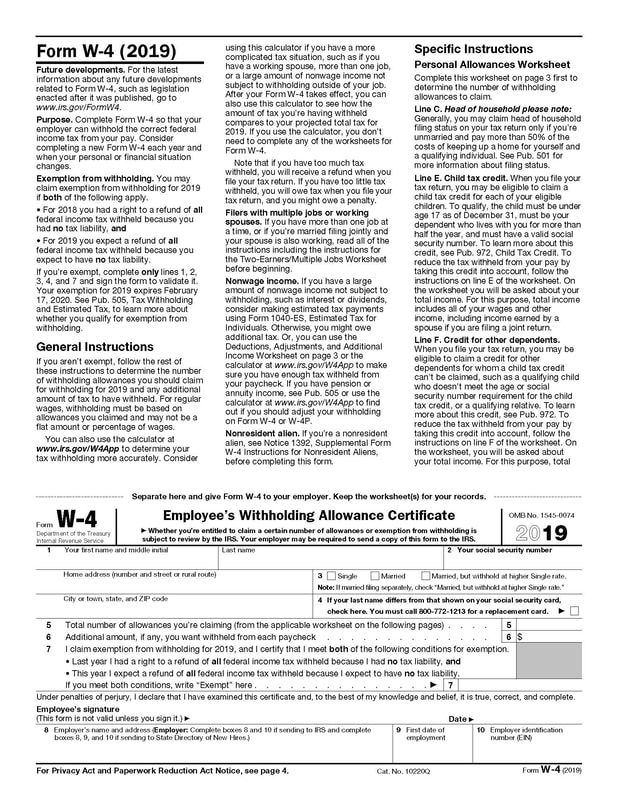

The IRS has released a new Form W-4 for 2020. This form is provided to employers by their employees to authorize the proper amount federal income tax to be withheld from the employee’s paycheck. The previous version of this form was believed to be confusing because an employee had to come up with a number of allowances and the employer would use those allowances to calculate withholdings.

The new form has been renamed “Employee’s Withholding Certificate” from “Employee’s Withholding Allowance Certificate” because allowances are no longer used. The new form is now a full page (previously less than half a page), however, if you have multiple jobs or deductions you may need to use the worksheets provided. The result of the new form is that it provides an actual dollar amount of additional income, deductions, or additional withholdings.

The most simple scenario is if you are single, have one job, and no other income or deductions other than the standard deduction, you can fill out the applicable information in Step #1, and skip to Step #5 where you sign the W-4. Similarly if you are married and you and your spouse both earn the same amount of wages, with no other income or deductions you can check the box in #2c. Filling out the form gets more complicated when you have to consider deductions, adjustments, and more than one job. However, those steps should only be filled out on the new Form W-4 for the highest paying job.

Step #2 recommends that you complete the W-4 estimator at the IRS website for most accurate withholdings. This process will be modified slightly to be in line with the new Form W-4, but the calculation is the same as it has been previously where you need to have your latest paystubs on hand and a copy of your prior year tax return is also helpful so you can see what other activity you had. See our previous blog post which details how to use the estimator. Note that the IRS has not updated the estimator in advance and recommends that you run the estimator for 2020 shortly into January.

If you don’t use the estimator and have multiple jobs, you skip to page 3 which calculates additional withholdings to be withheld from the highest job. Those additional wages should be entered in Step #4(c).

The most simple scenario is if you are single, have one job, and no other income or deductions other than the standard deduction, you can fill out the applicable information in Step #1, and skip to Step #5 where you sign the W-4. Similarly if you are married and you and your spouse both earn the same amount of wages, with no other income or deductions you can check the box in #2c. Filling out the form gets more complicated when you have to consider deductions, adjustments, and more than one job. However, those steps should only be filled out on the new Form W-4 for the highest paying job.

Step #2 recommends that you complete the W-4 estimator at the IRS website for most accurate withholdings. This process will be modified slightly to be in line with the new Form W-4, but the calculation is the same as it has been previously where you need to have your latest paystubs on hand and a copy of your prior year tax return is also helpful so you can see what other activity you had. See our previous blog post which details how to use the estimator. Note that the IRS has not updated the estimator in advance and recommends that you run the estimator for 2020 shortly into January.

If you don’t use the estimator and have multiple jobs, you skip to page 3 which calculates additional withholdings to be withheld from the highest job. Those additional wages should be entered in Step #4(c).

- Step #3 relates to dependents (but only if your income is below the phase-out threshold for receiving a tax credit).

- Step #4(a) relates to other non-wage income. If you have interest income, capital gains, or retirement income enter the total amount of income on this line.

- Step #4(b) relates to adjustments and deductions in excess of the standard deduction.

Still have questions? Feel free to reach out to your accountant for help filling out the form. You can reach us at (603)224-2000.

RSS Feed

RSS Feed